Contents:

It shows traders that the bulls do not have enough strength to reverse the trend. A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for traders to consider opening a long position to profit from any upward trajectory.

Bitcoin’s Horizontal Levels Show Potential For Bullish Trend – Bitcoinist

Bitcoin’s Horizontal Levels Show Potential For Bullish Trend.

Posted: Sat, 01 Apr 2023 00:01:18 GMT [source]

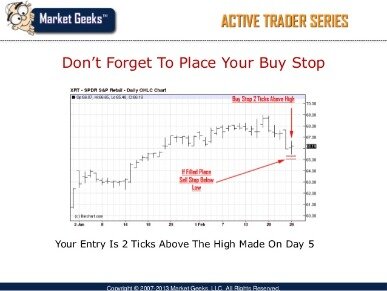

I use it for my VWAP-hold high-of-day break pattern. If a stock has been holding above VWAP all day and it’s after 2 p.m., that’s a very bullish indicator. I’ll buy it if it has other bullish indicators too. Investors are bullish on a market, so they invest in it. This cycle continues, often ending up in a market bubble.

Author’s Recommendations: Top Trading and Investment Resources To Consider

Two candlestick patterns characterize a bullish engulfing chart pattern. Its body is entirely engulfed by the second candle that bears no regard to its tail shadow’s length. The first candle can either be red or black, while the second candle may be green or white.

It is still considered a bullish candlestick pattern because it overcomes the downward momentum to close at least midway into the body of the previous candle. The result is a bullish candlestick pattern that engulfs the efforts of the bears. For the long-biased trader, the opportunity is perfect. You can develop your skills in a risk-free environment by opening an IG demo account, or if you feel confident enough to start trading, you can open a live account today.

Understanding Japanese Candlesticks

After at least three waves, the price will break the resistance zone, and a new bullish trend will start. In the first phase, you’ll have to identify a bullish impulsive wave. It means when there must be a strong bullish trend. A retracement wave will form in the second phase after the impulsive wave. Please keep in mind that this retracement will be more minor in size. The volume signature will likely appear elevated as supply is being absorbed, keeping the candles small in the presence of selling pressure.

- The third bearish candle opens with a gap down and fills the previous bullish gap.

- Once you are ready, enter the real market and trade to succeed.

- You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- This cycle continues, often ending up in a market bubble.

- From the inverse head and shoulder, double bottom, triple bottom to the rounding bottom chart pattern, it can be overwhelming.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

But the pennant has a flagpole at the start of the pattern. This is not present in the formation of the symmetrical triangle. Pennants can be seen when a security experiences a large upward or downward movement, followed by a short consolidation, before continuing to move in the same direction.

Before you start trading, it’s important to familiarise yourself with the basics of candlestick patterns and how they can inform your decisions. In fact, being able to see the bullish vs bearish candlesticks and patterns helps you know which trading strategy would work best in any given situation. One example is the AAII bullish or bearish surveys that go out. There is less risk involved by waiting for the confirming breakout. Buyers can then reasonably place stop-loss orders below the low of the triangle pattern.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Day 3 opened with a spectacular gap up, but the bulls were promptly rejected by the bears at the now established resistance line. A potential buy signal might be given on the day after the Tweezer Bottom, if there were other confirming signals. Sometimes Tweezer Tops or Bottoms have three candlesticks.

Six bearish candlestick patterns

Then you sell the stock for $10.40 per share, collecting $1,040 and making a $40 profit. In this case your long position would have been profitable. If the price dropped to $9.50, your long position would not have been profitable because you’d lose $50. Here I have explained a brief introduction to each chart pattern so you can get an overview. However, if you want to get a detailed guide, you can also click on the learn more button at the end of each pattern. Piercing Lines can offer a great risk to reward at the lows of support.

Being bullish vs bearish on a stock is an important distinction to make when your money is involved. Whether you are one or the other is a matter of market sentiment. Do you know how to profit in bull and bear markets? Learning how to capitalize in both markets can help you to become a more diverse trader. Let us say that Paul was observing DBC stock’s candlestick chart to look for an entry point.

What are the best four bullish continuation patterns?

This week sells might be the retest on the handle before continuation to the upside . In my most recent analysis on BTC.D I wrote that we were at an important resistance area. We would either blast through the resistance, and continue the Bitcoin-only bullish move, or we’d see a reversal where alts would start to outperform Bitcoin by a large margin. As seen on the chart, BTC.D has seen a reversal from the top resistance area. It indicates a rising buying pressure as the price rises above the mid-price of the previous day.

The formula is the same for every time frame chart you are viewing. The second candle opens far below the first and last candles. I review the intraday and daily charts on StocksToTrade.

The inverted hammer is a bullish signal that only occurs at the bottom of a downtrend. On the other hand, the shooting star is a bearish signal that appears at the top of a rising trend. Volume-weighted average price is critical to my trading. It indicates whether bulls or bears are in control. If the price is above VWAP, longs are more profitable than shorts. If the price is below VWAP, shorts are more profitable than longs.

Steel Buyers Brace For A Bumpy 2023 – Yahoo Finance

Steel Buyers Brace For A Bumpy 2023.

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

bullish engulfing definition kept pushing prices up to make a high but then sellers came in and pushed it down to a close below the high resulting in the upper shadow or upper wick. The more trading sessions that are engulfed by a single candlestick, the stronger the signal. Bullish flags are short-term patterns that ideally last one to four weeks, typically don’t last longer than eight weeks, and usually follow an sharp uptrend. But if the stock breaks below the rising support level, a short trade signal would be generated. A double bottom is a bullish reversal pattern that describes the fall, then rebound, then fall, and then second rebound of a stock.

The https://trading-market.org/ bear market most likely came from both parable and practice. It generally relates to the trade of bear skins during the 18th century. During this era fur traders would, on occasion, sell the skin of a bear that they had not caught yet. They did this as an early form of short selling, trading in a commodity they did not own in the hopes that the market price for that commodity would dip. When the time came to deliver on the bearskin the trader would, theoretically, go out and buy one for less than the original sale price and make a profit off the transaction.

When you spot a bullish chart pattern in the forex market, there are a few key steps you can take to potentially take advantage of the pattern and make profitable trades. But before we dive into the fun stuff, let’s define what exactly a bullish market is. A bullish market simply means that the overall sentiment is optimistic and investors believe that the prices will rise. This is the opposite of a bearish market, where the sentiment is negative and prices are expected to fall. The second candle signified a day when immense selling pressure was in the morning.

These patterns, as the name suggests, indicate a bullish market sentiment and can potentially signal profitable trades. For a bullish engulfing pattern to form, the stock must open at a lower price on Day 2 than it closed at on Day 1. If the price did not gap down, the body of the white candlestick would not have a chance to engulf the body of the previous day’s black candlestick.

You can be bullish on a stock for the day, but bearish for the long term. Bearish candles can indicate a reversal in a bullish trend. And bullish candles can indicate a reversal in a bearish trend. Penny stock traders need to constantly adapt to the market. That’s why I don’t like short selling in this crazy bull market. Most of the time, the U.S. stock market is in a bull market.

Cardano ($ADA) Poised for Major Breakout Amid Bullish Crypto … – CryptoGlobe

Cardano ($ADA) Poised for Major Breakout Amid Bullish Crypto ….

Posted: Fri, 14 Apr 2023 02:33:11 GMT [source]

A candlestick helps to display the information of an asset’s price movements in the market. It consists of an opening and closing price and the highs and lows of a single day. They are the most popular trading components that help traders make technical analyses when interpreting an asset’s price information.

This bullish advance on Day 2 sometimes eliminates all losses from the previous day. We also include a list of resources to other candlestick technical analysis tools at the end of the guide. Welcome back to another trade with analyst Aadil1000x. Today I have analyzed the next 6 steps of ETH for the A1000x members.